Other times, it’s business owners promising to make you a millionaire - all you have to do is give them your money first. As a result, what users end up seeing often isn’t good advice from trusted sources, it’s just one random person’s experience making thousands of dollars off buying and selling Tesla calls. TikTok’s ability to take an average user’s video and show it to millions of people in a matter of hours or days is unmatched.

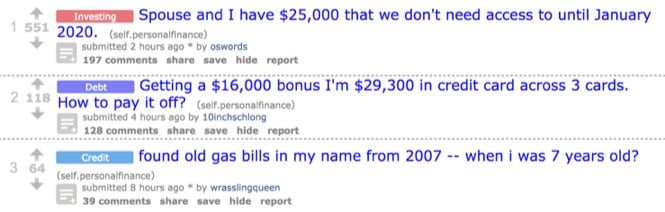

REDDIT PERSONAL FINANCE INVESTING HOW TO

Personal finance TikTok, also known as #FinTok or #StockTok, has become a massively popular segment of the app that, at its best, is made up of experts who make videos discussing how to get out of credit card debt, explaining the difference between a Roth IRA and a 401(k), and encouraging young people to start investing for retirement.Īt its worst, however, Finance TikTok perpetuates financial myths, scams, and dangerously misleading information. They are also learning dubious financial information from unverified sources with millions of followers.

“But I didn’t want to be infamous on the forum for losing all my gains.People are learning all kinds of new things on TikTok: how to do viral dances to popular songs, how to make hot cocoa bombs or paint an accent wall. “I don’t really want to stop trading options and reading WallStreetBets because it’s entertaining and funny,” Choi said. Choi said he wants to avoid the spotlight, so he cashed out his much smaller big short rather than risk the ridicule of his online community. In the movie, The Big Short, Michael Burry was played by actor Christian Bale. Take, for example, a posting from joeyrb that offered an explanation of why the VIX Index hasn’t spiked during the trade war: “Of course, there are threads where people are just trolling, but you can find good entry points.” “I use it to develop my watch list,” Choi said. 24 - the first time it closed below $297 in more than two weeks - his US$297 puts that were set to expire on Sept. Choi doubled his Roku winnings by buying more puts, this time on the S&P 500 exchange-traded fund. Bloomberg confirmed Choi’s account via screen shots of his Robinhood Financial trading history.Ī few days later, lightning struck again. The profit was so meaty because the puts Choi bought were close to expiration and far out of the money. 20, Choi’s initial US$766 investment in Roku puts - a bet that the stock would decline - ballooned to US$50,553 overnight, a 6,500-per-cent gain. When the stock of Roku, a streaming-service provider whose shares tend to fluctuate, cratered 19 per cent on Sept. “When I see these people making a lot and losing a lot of money, it caught my attention.”

“I’m naturally a risk-loving person,” Choi said in an interview. Choi became a rock star on the forum last month after sharing details of his own big short - playing Roku Inc. Choi said WallStreetBets taught him how to trade options - contracts that offer the right to buy or sell a security by a specific date.

REDDIT PERSONAL FINANCE INVESTING TV

The forum’s 600,000 members dub satirical options-trade commentary over scenes from TV shows like It’s Always Sunny in Philadelphia and rant about a loss that caused a member to get their “face ripped off.” Toss in a smidge of casual racism and a whiff of locker-room misogyny, and WallStreetBets is a window into the back rooms of a seedy stock-market casino with no Burry to be found. The sub-Reddit WallStreetBets, with the tagline “Like 4chan found a Bloomberg terminal,” is rarely any of those things. Burry’s posts were thoughtful, well-reasoned and showed deep research. Before he became famous for the big short in the 2000s, Michael Burry discussed stock trades on online message boards.

0 kommentar(er)

0 kommentar(er)